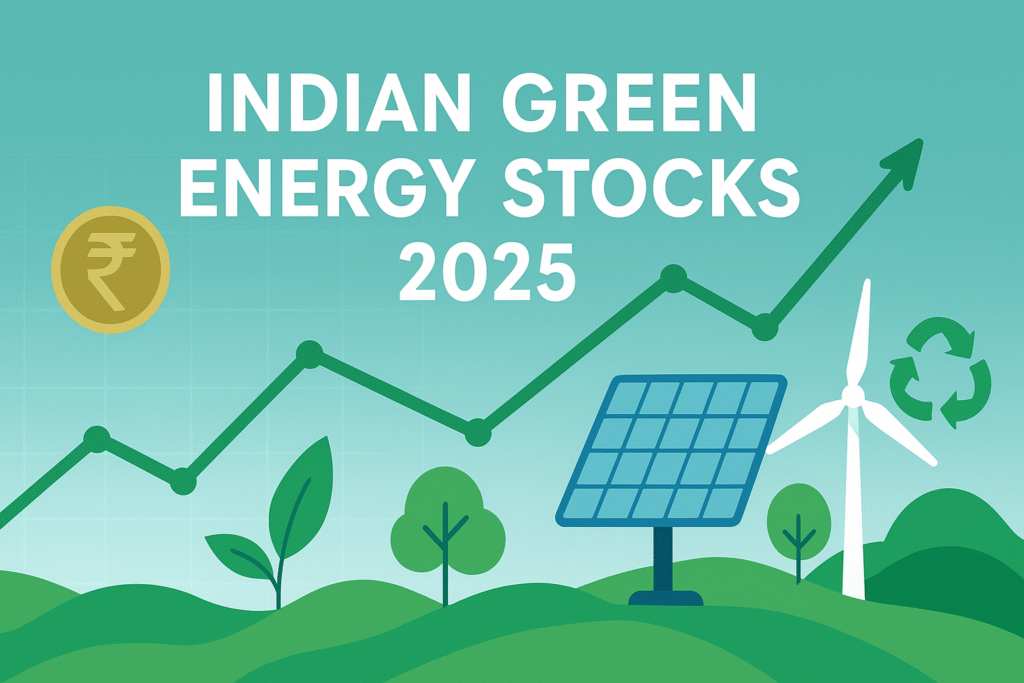

Now Reading: Suzlon Energy Share Price Forecast 2026: Will the Stock Rebound?

- 01

Suzlon Energy Share Price Forecast 2026: Will the Stock Rebound?

Suzlon Energy Share Price Forecast 2026: Will the Stock Rebound?

Suzlon Energy, one of India’s top wind energy companies, has seen big ups and downs in its stock price. After facing debt troubles in the past, the company is now recovering. But will Suzlon’s share price grow by 2026?

Table of Contents

Suzlon Energy: Company Overview

Suzlon Energy is a leading Indian wind turbine manufacturer with a strong presence in renewable energy. The company has faced challenges in the past, including high debt and financial losses, but recent improvements have made investors hopeful.

Key Facts About Suzlon (2024

| Current Share Price | ₹57.9 (as of 24 March 2025) |

|---|---|

| 52-Week Range | ₹36.8 (Low) to ₹86 (High) |

| Market Cap | ₹78,414 Crore |

| Debt Reduction | Successfully cut debt from ₹12,000 Cr (2019) to ₹1,200 Cr (2024) |

| Order Book | Over 1,500 MW in new projects |

| Data sources: Company reports, stock exchanges | |

Suzlon Share Price Forecast 2026: Bullish vs. Bearish Views

Analysts have mixed opinions on Suzlon’s future stock price. Here’s what experts predict:

✅ Bullish Case (Upside Potential)

- Government Support: India’s push for 500 GW renewable energy by 2030 will boost wind power demand.

- Strong Order Book: New projects from Adani Green, Tata Power, and others could increase revenues.

- Debt-Free Future: If Suzlon clears all debt, profits may rise sharply.

- Price Target: ₹80–₹150 per share by 2026 (based on ICICI Securities, Motilal Oswal reports).

❌ Bearish Case (Risks & Challenges)

- Competition: Rivals like Inox Wind, Siemens Gamesa are growing fast.

- Global Supply Issues: Rising turbine material costs could hurt margins.

- Stock Volatility: Suzlon’s history of sharp price swings may continue.

- Worst-Case Scenario: If growth slows, the stock could fall back to ₹30–₹50.

| Year | Minimum Price (₹) | Maximum Price (₹) | Key Factors |

|---|---|---|---|

| 2024 | 35 | 60 | Debt reduction, order book growth |

| 2025 | 50 | 90 | Renewable energy policy boost |

| 2026 | 80 | 150 | Market expansion, global demand |

| Source: Analyst reports (ICICI, Motilal Oswal), Suzlon financial statements | |||

5 Key Factors That Will Decide Suzlon’s Stock Price in 2026

| # | Factor | Impact |

|---|---|---|

| 1 | Government Policies | More subsidies for wind energy = higher profits |

| 2 | Debt Management | If Suzlon becomes debt-free, investors will gain confidence |

| 3 | Global Energy Trends | Rising oil prices could push demand for renewables |

| 4 | New Orders & Partnerships | Big contracts = higher stock price |

| 5 | Competition | If rivals like Inox capture more market share, Suzlon may struggle |

Should You Invest in Suzlon Energy for 2026?

Good For:

- Long-term investors betting on India’s renewable energy boom.

- High-risk traders who can handle stock volatility.

Avoid If:

- You want safe, stable returns (Suzlon is still risky).

- You expect quick profits (this is a 3–5 year play).

Tip: Suzlon has strong growth potential, but only invest if you’re okay with risk.

Conclusion

Suzlon Energy’s 2026 stock price will depend on government policies, debt control, and new orders. While analysts predict ₹80–₹150, always do your own research before investing.

Want more stock forecasts? Explore our latest analysis here. Shakti Pumps Multibagger Solar Stock

FAQ: Suzlon Energy Stock Forecast 2026

Q1. What is the highest price Suzlon can reach by 2026?

If all goes well, ₹150–₹200 is possible.

Q2. Is Suzlon a multibagger stock?

It could be, but only if the company keeps reducing debt and winning big orders.

Q3. What’s the biggest risk in Suzlon stock?

Debt and competition—if these aren’t managed, the stock may fall.

Disclaimer:

We are not SEBI-registered investment advisors. The information provided in this article is for educational purposes only and should not be considered financial advice. Please conduct your own research or consult a professional before making any investment decisions.

Pingback: RailTel Share Price Forecast 2025: Will the Latest ₹19.84 Crore Order Boost the Stock? | Openatalk

zoritoler imol

I would like to thnkx for the efforts you’ve put in writing this site. I’m hoping the same high-grade web site post from you in the upcoming as well. Actually your creative writing skills has inspired me to get my own website now. Actually the blogging is spreading its wings fast. Your write up is a good example of it.

ที่ปรึกษาการทำ seo

Link exchange is nothing else except it is simply placing the other

person’s web site link on your page at proper place and other person will also do similar in support of you.

vorbelutr ioperbir

Really instructive and wonderful complex body part of content, now that’s user friendly (:.